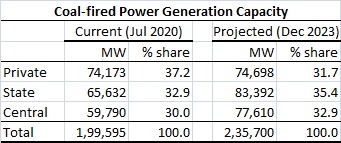

Today, the private sector is the biggest owner of coal-fired power capacity with a share of 37 per cent. By December 2023, this share will drop to 32 per cent. State government entities with a projected share of 35 per cent will constitute the single-largest ownership.

According to information tabled in Parliament recently, coal-fired power plants aiming to add 59,810 mw (or nearly 60 GW) are currently under construction. These projects are spread over all forms of ownership – Central government, state governments and private sector.

Out of this 59,810 mw capacity that is under construction, 36,105 mw is what is likely to materialize in phases beginning October 2020 up to December 2023. The remaining capacity, which is 23,705 mw, represents projects that are unlikely to fructify. These may include projects that are put on hold, projects that are under financial stress or projects whose fate is uncertain for one reason or the other.

Out of this 59,810 mw capacity that is under construction, 36,105 mw is what is likely to materialize in phases beginning October 2020 up to December 2023. The remaining capacity, which is 23,705 mw, represents projects that are unlikely to fructify. These may include projects that are put on hold, projects that are under financial stress or projects whose fate is uncertain for one reason or the other.

It is very interesting to note that almost the entire 23,705 mw that is unlikely to materialize comes from private sector projects. Government projects, on the other hand, have an insignificant proportion of “stressed” projects.

Several years ago, India has pledged that all new coal-fired power plants would be based on supercritical technology. One can see the implementation of this proposal on ground. Of the 36,105 mw of likely capacity addition discussed above, 33,400 mw will come from supercritical power plants. The remaining 2,705 mw stands for non-supercritical (or subcritical) projects. These are projects are those that were planned before the supercritical mission and whose commissioning has been delayed.

It may also be highlighted here that existing subcritical power plants, which are currently in operation, are being retrofitted with flue gas desulphurization (FGD) units, with a view to controlling SOx and NOx emissions.

Private sector detached

When India opened up its power sector to private sector participation back in the early 1990s, there was a flurry of activity from multinationals to set up coal-fired power plants in India. This frenzy continued for around two decades, with Indian private sector entities also joining the fray. Now, it appears that the phenomenon has turned a full circle and one can confidently expect that private enterprise would like to stay clear of coal-fired power generation, or any other form of thermal power generation, for that matter. It is not as if the private sector is moving away from power generation per se; the new focus area is renewable energy, mainly wind and solar.

All the same, Central and state government entities are still pursuing coal-fired power plants, given that India’s dependence on coal cannot be wished away. Despite the growing emphasis on clean energy sources, coal-fired plants will continue to meet the country’s base load, at least in the foreseeable future.

Also read: State transcos should strongly consider forming JVs with PGCIL

State government: Biggest owner

With practically no new coal-fired power plants from the private sector expected, a change in the ownership pattern is expected in the years ahead. As of end-July 2020, India had nearly 2 GW of aggregate coal-fired power generation capacity. Private sector entities constituted the biggest ownership with a share of 37 per cent. State government entities owned 33 per cent and Central government agencies, 30 per cent.

What is noteworthy is that by December 2023, the share of private entities in India’s total coal-fired power capacity will drop to 32 per cent. State government entities will be the single largest holder of coal-fired power capacity, with a share of 35 per cent, with Central agencies owing the remaining 33 per cent.

Thus, the ownership concentration of coal-fired power plants will move to state government entities by December 2023, from private sector now.